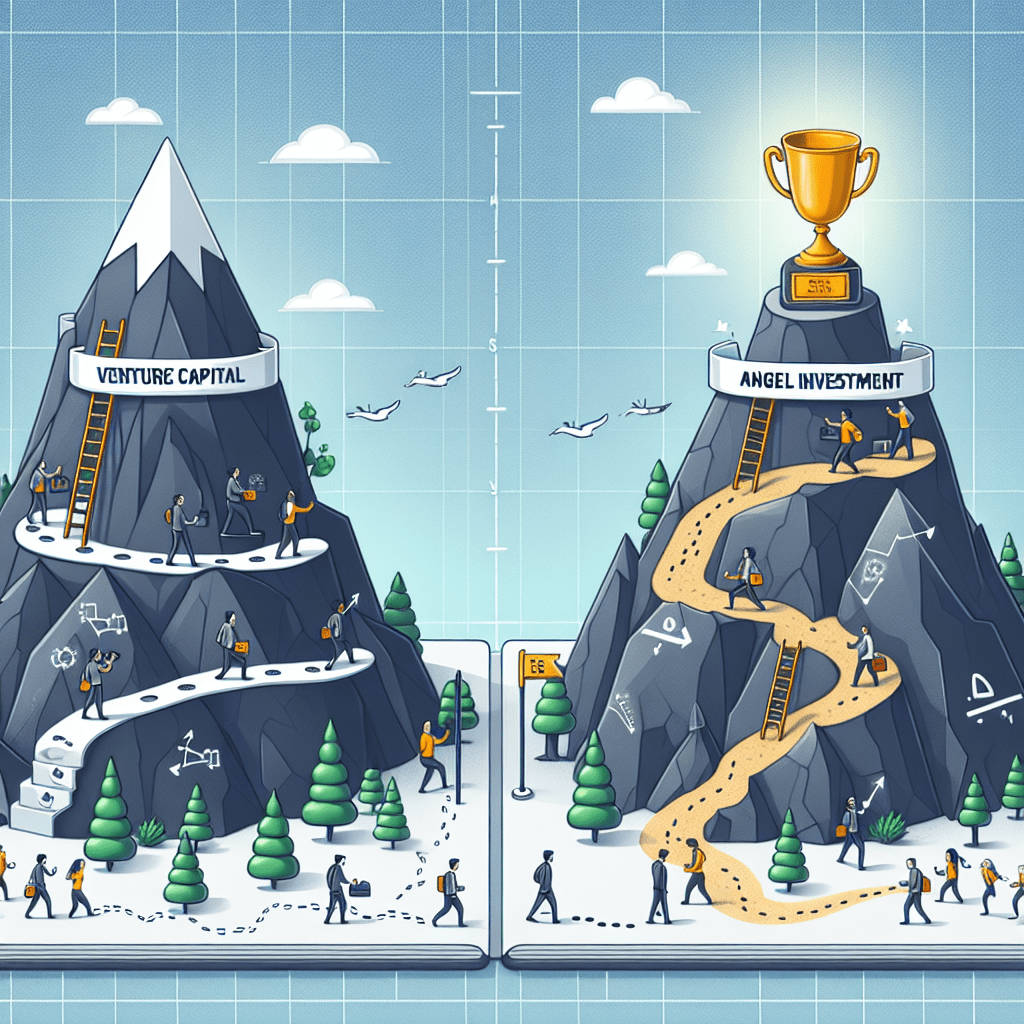

Starting a new business is both an exciting and challenging journey. Entrepreneurs often find themselves at a crossroads when it comes to funding their startups. Two prominent funding options that loom large on the landscape are venture capital and angel investment. In this article, we will explore what each of these funding avenues entails, their advantages and disadvantages, and which might be best suited for your unique startup needs.

Understanding Startup Funding

Before diving into the specifics of venture capital and angel investment, it’s critical to grasp the broader context of startup funding. Startup funding is essential for growth; it helps businesses cover costs like product development, marketing, employee salaries, and operational expenses.

Funding sources can be categorized into various types, including personal savings, loans, crowdfunding, angel investors, venture capitalists, and grants. Each of these options has its own implications for control, return on investment, and long-term effects on your business.

What is Venture Capital?

Venture capital (VC) refers to a type of funding that predominantly comes from institutional investors or firms that focus on rapidly growing businesses. These investors typically seek a high return on investment (ROI) within a set timeframe, often around 5 to 10 years.

How Does Venture Capital Work?

Venture capitalists invest in startups in exchange for equity—meaning they’ll own a portion of the business. The investment process usually includes the following stages:

- Pitching: Entrepreneurs present their business plans and visions to potential venture capitalists.

- Due Diligence: After a successful pitch, VC firms will perform extensive research and analysis to evaluate the startup’s business model, competitive landscape, and management team.

- Investment: If the VC firms are satisfied, they will provide funding in exchange for shares in the startup.

Advantages of Venture Capital

- Large Amounts of Capital: VCs often invest substantially, providing startups with the needed funds for rapid growth.

- Expertise and Mentorship: Many VCs bring a wealth of experience and can provide valuable mentorship, networking, and strategic advice.

- Increased Credibility: Having reputable VCs on board can attract additional funding and enhance your startup’s credibility.

Disadvantages of Venture Capital

- Loss of Control: Accepting VC funding often means giving up some control over business decisions as investors will typically want a say in operations and direction.

- High Expectations: The pressure to deliver results quickly can be overwhelming; VCs often expect significant returns within a short timeframe.

- Limited Focus on Short-Term Gains: VCs may push for strategies that prioritize rapid growth over sustainable business practices.

What is Angel Investment?

Angel investment refers to funding provided by individuals, known as angel investors, who invest their personal finances in startups, often in exchange for equity or convertible debt. Unlike venture capitalists, angel investors usually use their own money and tend to invest in earlier stage companies.

How Does Angel Investment Work?

The process for securing angel investment typically follows a simpler structure compared to venture capital:

- Networking: Entrepreneurs often need to leverage personal connections or angel investor networks to find potential investors.

- Presents Business Plans: Similar to VCs, entrepreneurs present their ideas and business strategies to their potential angel investors.

- Investment Terms: If an angel investor is interested, they will negotiate terms, often more flexible than those imposed by VCs.

Advantages of Angel Investment

- Less Stringent Requirements: Angel investors might have more lenient conditions compared to VCs, making it easier to secure funding for earlier-stage companies.

- More Flexibility: Angel investors often take a more personal approach and may be willing to accept non-standard investment terms

- Longer Time Horizon: Angels may be more patient than VCs concerning return on investment and are often less demanding about quick growth.

Disadvantages of Angel Investment

- Limited Capital: Angels typically invest less money than venture capitalists, which may not be enough for companies looking to scale rapidly.

- Variable Involvement: The level of support and mentorship can fluctuate widely among angel investors, meaning that some may provide little additional value beyond capital.

- Stage of Business: Angels often prefer businesses in the seed or early stage, which might be unsuitable for companies looking for significant growth capital.

Key Differences Between Venture Capital and Angel Investment

Understanding the distinctions between venture capital and angel investment can greatly influence your startup financing strategy. Here are the main differences:

- Source of Capital: VCs are typically institutional investors or firms, while angel investors are individuals investing their personal funds.

- Investment Size: VCs generally make larger investments compared to angel investors.

- Stage of Investment: Angels usually invest in earlier stages of a startup, while VCs often prefer businesses that have proven their concept and are looking to scale.

- Expectations: VCs have high ROI expectations and usually want returns within 5-10 years, while angel investors might be more relaxed with their timelines.

- Control and Involvement: VCs tend to demand more control in business decisions, while angels may offer more flexibility in this area.

Which is Best for Your Startup?

The choice between venture capital and angel investment depends on several factors:

1. Stage of Your Business

If your startup is in the early stages (idea or seed stage), angel investment may be more suitable. Conversely, if you have a proven business model and are seeking to scale rapidly, venture capital may be your best bet.

2. Funding Requirements

Consider how much capital you need. If you require a small amount, an angel investor might be the right option. However, if your business demands significant funding, venture capital might be necessary.

3. Desired Involvement

Think about the degree of control you are comfortable giving away. If you want to retain more autonomy, angel investors may offer a more suitable arrangement compared to venture capitalists, who often desire significant input on strategy and direction.

4. Long-Term Goals

Your long-term growth aspirations and exit strategy will play a substantial role. In general, VCs are more focused on achieving high growth within a defined period, whereas angel investors may prioritize helping you build a sustainable business.

Conclusion

Choosing between venture capital and angel investment is crucial for your startup’s future. Each option has its distinct advantages and disadvantages, catering to different stages, capital needs, involvement preferences, and long-term goals.

By carefully assessing your business model, financial requirements, and goals, you can determine which funding source aligns best with your startup’s vision. Whether opting for angel investors or venture capitalists, secure your investment wisely and prepare for an exciting entrepreneurial journey ahead!

Frequently Asked Questions (FAQs)

1. What is the primary difference between angel investors and venture capitalists?

Angel investors invest their personal money in startups and often focus on early-stage companies, while venture capitalists operate through firms that manage pooled funds from institutional investors and often pursue businesses that have demonstrated growth potential.

2. Can I use both angel investment and venture capital for my startup?

Yes, many startups use a combination of both funding sources. It’s common for entrepreneurs to initially secure angel investment and then seek venture capital as their business scales.

3. How can I find angel investors?

You can find angel investors through networking events, pitching competitions, online platforms specialized in connecting startups with investors, or by reaching out to local business incubators and accelerators.

4. What do investors typically look for in a startup?

Investors generally assess the strength of your business model, market potential, management team, competitive advantage, and financial projections before making an investment decision.

5. Is equity the only option for funding from angel investors and venture capitalists?

While equity is the most common form of compensation for funding, some angel investors and VCs might offer convertible debt or other financing arrangements. Always discuss options with potential investors during negotiations.

#Venture #Capital #Angel #Investment #Whats #Startup