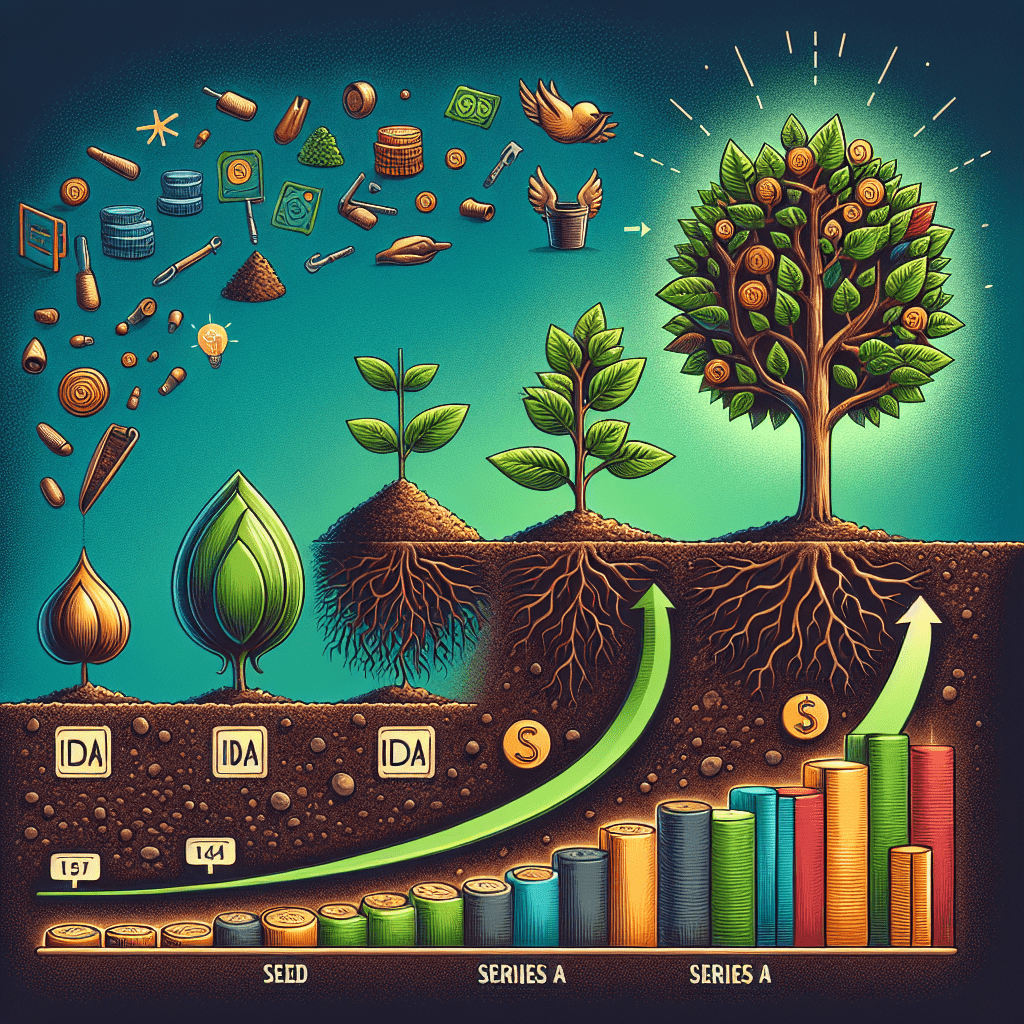

Starting a business can be an exhilarating venture, but it’s also fraught with challenges, especially when it comes to financing. Understanding the various stages of startup funding is crucial for entrepreneurs looking to bring their visions to life. This article explores these stages in detail, offering insights on how startups can navigate the journey from seed funding to Series A rounds.

What is Startup Funding?

Startup funding refers to the financial resources that entrepreneurs seek to develop their business ideas. It is a vital component of the entrepreneurial ecosystem, providing the necessary capital to launch, grow, and scale a startup. Funding can come from various sources, including individual investors, venture capital firms, banks, and crowdfunding platforms.

Overview of Funding Stages

Startup funding typically occurs in several stages, each with its own distinct purpose and characteristics. The main stages include:

- Seed Stage

- Pre-Series A Stage

- Series A Stage

1. Seed Stage

The seed stage is where it all begins. At this stage, entrepreneurs have a business idea and aim to validate it through a minimum viable product (MVP) or prototype. The primary goal is to gain initial traction and prove that the concept has a market.

Funding Sources for Seed Stage

Funding in the seed stage typically comes from:

- Personal Savings: Many entrepreneurs invest their own money to get things started.

- Family and Friends: Funding often comes from close connections who believe in the entrepreneur’s vision.

- Angel Investors: Wealthy individuals who provide capital for startups, often in exchange for equity.

- Crowdfunding: Platforms like Kickstarter or Indiegogo where entrepreneurs can raise small amounts of money from a large number of people.

Challenges in the Seed Stage

Startups often face several challenges in the seed stage, including:

- Convincing investors to support an unproven concept.

- Limited resources to develop the product or service.

- Finding the right market fit.

2. Pre-Series A Stage

Once a startup has validated its idea and gained initial traction, it enters the pre-Series A stage. This stage focuses on scaling the business and preparing for larger investments. Startups look for funding to expand their team, enhance their marketing efforts, and improve their product.

Funding Sources for Pre-Series A Stage

Funding during this stage may come from:

- Convertible Notes: A loan that converts into equity at a later funding round.

- Venture Capital: Firms that provide capital to startups in exchange for equity, especially if the startup shows strong growth potential.

- Incubators and Accelerators: Programs offering funding, mentorship, and resources in exchange for equity or future funding commitments.

Challenges in the Pre-Series A Stage

As startups work toward the pre-Series A stage, they may encounter various challenges, including:

- Establishing a sustainable business model.

- Managing growing operational complexities.

- Competing against larger, established companies.

3. Series A Stage

By the time a startup reaches the Series A stage, it has demonstrated that its business model works and is ready for significant growth. This round of funding is crucial for scaling operations, entering new markets, and developing product offerings further.

Funding Sources for Series A Stage

Funding in this stage generally comes from:

- Venture Capital Firms: The primary source of capital for Series A, focusing on companies with proven business models and significant market potential.

- Institutional Investors: Larger entities that often take an interest in well-performing startups.

Challenges in the Series A Stage

In the Series A stage, startups may face challenges such as:

- Proving scalability and sustainability to potential investors.

- Managing higher operational costs.

- Navigating market competition while growing rapidly.

Conclusion

Understanding the stages of startup funding from seed to Series A is essential for entrepreneurs. Each stage presents unique challenges and opportunities that can significantly impact the growth trajectory of a startup. By recognizing the different funding sources and maintaining a clear vision, entrepreneurs can better strategize their funding efforts and take their startups to new heights.

FAQs

What is the difference between seed funding and Series A funding?

Seed funding is the initial capital used to support the early development of a startup, while Series A funding is a later round of financing aimed at scaling the business after proving its viability.

How much money do startups usually raise in the seed stage?

Seed funding amounts can vary widely, but startups typically raise between $10,000 to $2 million in this stage, depending on their business model and market potential.

What are the key criteria for investors in the Series A stage?

Investors typically look for a proven product-market fit, strong traction in terms of sales or user growth, a capable team, and a scalable business model during the Series A stage.

Can you skip the seed stage and go straight to Series A funding?

While possible, skipping the seed stage is uncommon. Most investors prefer to see some validation of the product or service before committing larger amounts of capital in a Series A fund.

TIP

Always ensure that you have a solid business plan that outlines your vision, strategies, and milestones for each funding stage. A well-prepared entrepreneur can significantly increase their chances of securing the necessary funding to grow.

#Seed #Series #Understanding #Stages #Startup #Funding