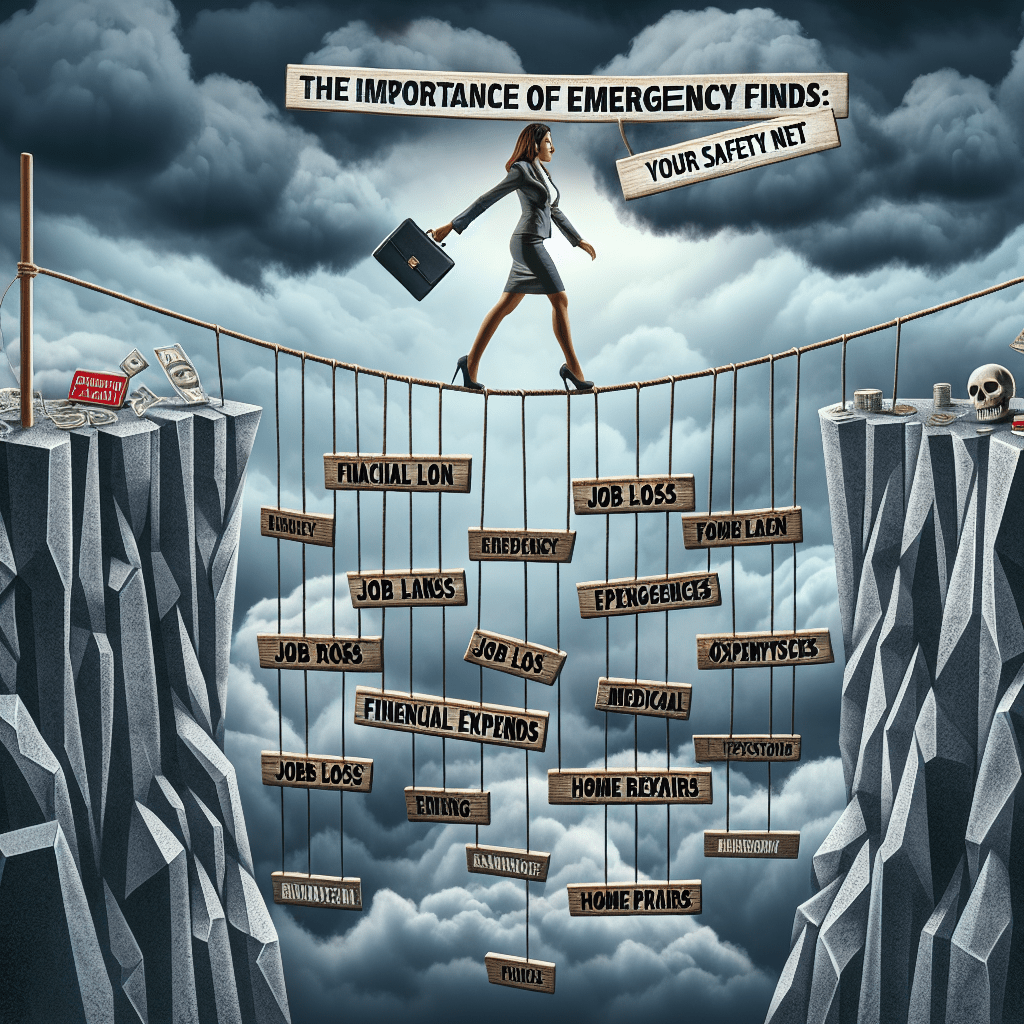

In financial planning, having a safety net is crucial. One of the most effective safety nets you can establish is an emergency fund. This fund can make the difference between financial stability and chaos in times of crisis. In this article, we’ll explore the importance of emergency funds, how to build one, and why they are a key component of effective financial planning.

What is an Emergency Fund?

An emergency fund is a dedicated savings account that is easily accessible and used exclusively for unexpected expenses. These can include:

- Medical emergencies

- Job loss

- Major car repairs

- Unexpected home repairs

- Family emergencies

In essence, an emergency fund is your financial buffer that enables you to navigate through unforeseen events without falling into debt.

Why You Need an Emergency Fund

There are numerous reasons why having an emergency fund is essential for anyone looking to achieve financial stability:

1. Protect Against Uncertainty

Life is unpredictable, and having an emergency fund allows you to handle sudden financial hurdles without derailing your financial progress. Whether it’s losing your job or facing a medical emergency, an emergency fund provides peace of mind.

2. Avoid Debt

Without an emergency fund, you may be forced to rely on credit cards or loans to cover unexpected costs. This can lead to high-interest debt that becomes a heavy burden. An emergency fund eliminates the need for such measures.

3. Financial Confidence

Having an emergency fund can boost your confidence in managing personal finances. Knowing you have a safety net enables you to make better financial decisions, whether regarding investments or large purchases.

4. Keep Your Long-Term Savings Intact

Without an emergency fund, you might need to dip into long-term savings, such as retirement accounts, to cover immediate costs. This can derail your long-term financial goals and diminish the effectiveness of compound interest.

5. Better Investment Opportunities

With a safety net in place, you can confidently pursue investment opportunities when they arise. You won’t have to worry about sudden expenses forcing you to liquidate investments at a loss.

How Much Should You Save?

The amount you need to save in your emergency fund can vary based on personal circumstances. Here are some guidelines to consider:

- Three to Six Months of Expenses: A commonly recommended goal is to save three to six months’ worth of living expenses. This can provide a significant cushion for most unexpected events.

- Individual Circumstances: Some people may need more than this, especially if they have fluctuating income, are self-employed, or have dependents.

- Monthly Budgeting: Calculate your essential monthly expenses, including rent/mortgage, groceries, utilities, and insurance. This will help you estimate how much you should aim to save.

How to Build Your Emergency Fund

Building an emergency fund doesn’t have to happen overnight. Here are practical steps you can follow to create your safety net:

1. Establish a Savings Goal

Set a specific target for your emergency fund based on your monthly expenses. This helps keep you focused and motivated.

2. Open a Separate Savings Account

To avoid using your emergency funds for non-emergencies, open a separate savings account that is dedicated solely to your emergency fund. Look for high-yield savings accounts to earn a little interest while you save.

3. Automate Your Savings

Set up automatic transfers from your checking account to your emergency fund savings account. Treat your savings like a recurring expense, and you won’t even notice the money is gone.

4. Start Small and Build Up

If saving several months’ worth of expenses feels overwhelming, start small. Aim to save $500, $1,000, or a month’s worth of expenses at a time. Gradually work your way up to your larger goal.

5. Cut Unnecessary Expenses

Review your budget to identify areas where you can cut expenses. This may include dining out less or canceling subscriptions you don’t use. Redirect these savings into your emergency fund.

Maintaining Your Emergency Fund

Once you’ve built your emergency fund, it’s important to maintain it:

1. Assess and Adjust Regularly

Review your financial situation regularly to determine if your emergency fund needs adjusting. If your expenses increase, you may need to boost your fund accordingly.

2. Replenish After Use

If you have to dip into your emergency fund, make it a priority to replenish it as soon as possible.

3. Keep It Visible

Keep your emergency fund account separate and visible. This will remind you of its purpose and discourage using the funds unnecessarily.

Conclusion

An emergency fund is a vital component of financial planning that provides protection against life’s uncertainties. By saving a small amount consistently over time, you can create a safety net that allows you to navigate unexpected expenses without the stress of debt. Whether you’re just starting your financial journey or looking to solidify your planning strategies, prioritizing the establishment of an emergency fund should be at the top of your list. Remember, financial stability doesn’t happen overnight—taking small, manageable steps towards building your emergency fund can lead to significant improvements in your financial health.

FAQs About Emergency Funds

1. How long should it take to build an emergency fund?

The time it takes to build your emergency fund depends on your savings rate and expenses. Some people may reach their goal in six months, while others may take a few years. Aim to save consistently and push towards your target gradually.

2. Can I use my emergency fund for planned expenses?

No, your emergency fund should be reserved for unexpected expenses only. Using it for planned expenses undermines its purpose as a safety net.

3. What if I can’t save three to six months of expenses?

Start with what you can and gradually build your fund over time. Any savings you can accumulate will provide some degree of protection.

4. Is it okay to invest my emergency fund?

It’s best to keep your emergency fund readily accessible in a savings account rather than investing it in the stock market. Emergencies require quick access to funds, whereas investments may not be easily liquidated at a moment’s notice.

5. What if I have debt? Should I focus on that instead of an emergency fund?

While paying off debt is important, it’s still wise to have a small emergency fund (e.g., $500 or $1,000) to avoid going deeper into debt when unexpected expenses arise. Once that fund is established, you can focus on debt repayment more effectively.

#Importance #Emergency #Funds #Safety #Net #Financial #Planning